What Is a Subject-To Closing?

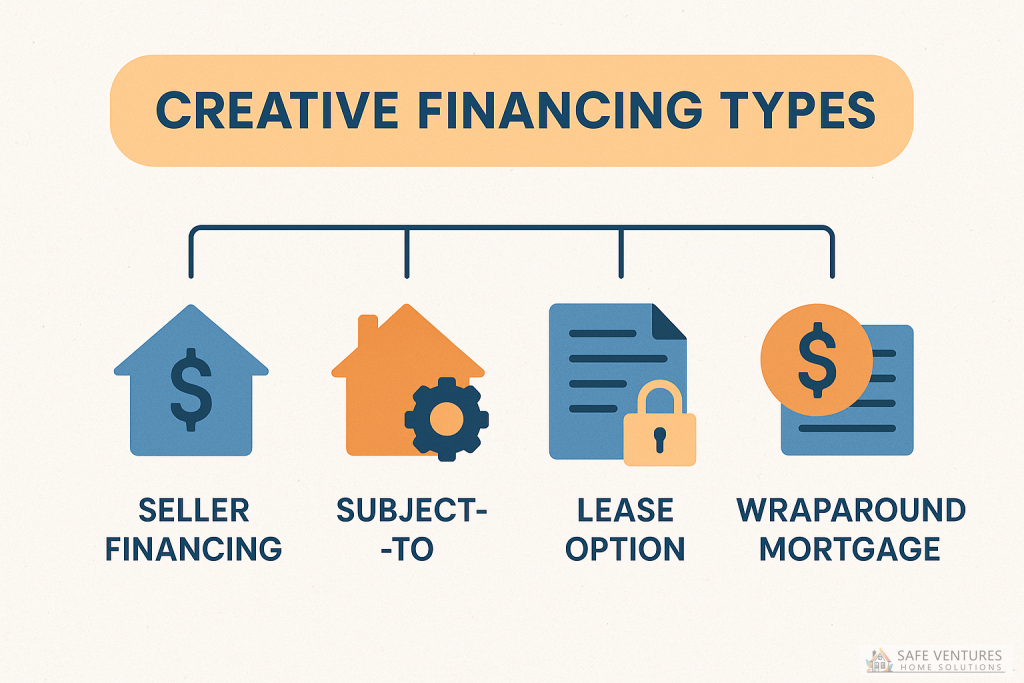

What Is Creative Financing?

Other common strategies include:

Seller financing – The seller acts as the bank and offers a loan directly to the buyer.

Seller financing – The seller acts as the bank and offers a loan directly to the buyer.

Lease options – The buyer leases the property with an option to buy later.

Wraparound mortgages – A new loan “wraps” around the existing mortgage.

Contract for deed – The buyer receives an equitable title and gains full title once payments are complete.

These tools can often be combined depending on the structure of the deal.

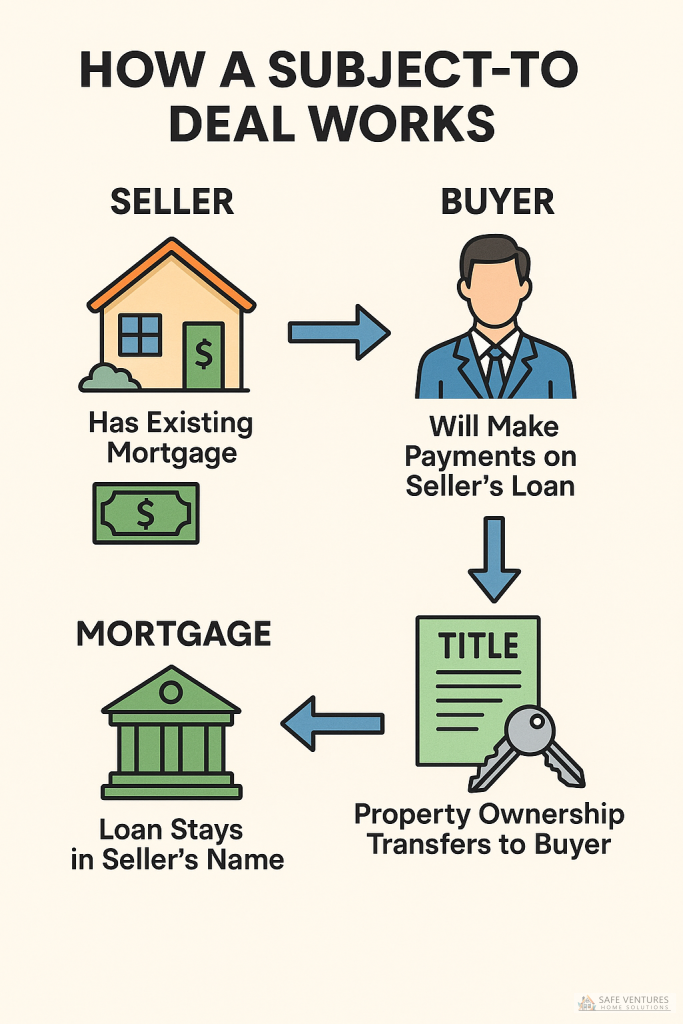

What Does “Subject-To” Mean?

In a subject-to transaction, a buyer purchases a property subject to the existing mortgage. This means that the mortgage stays in the seller’s name, but the buyer takes possession of the property and makes the ongoing mortgage payments.

For example, if a seller has a mortgage with a $150,000 balance at a 3% interest rate, a buyer might agree to purchase the home subject-to the existing mortgage. The buyer takes ownership of the property and begins making the monthly payments, but the loan remains in the seller’s name.

Key points:

- The mortgage remains under the seller’s name.

- Title (ownership) transfers to the buyer.

- The buyer is not assuming the loan officially with the lender.

- The lender is usually not notified (although this could trigger the “due-on-sale” clause — more on that below).

Why Would Sellers Agree to a Subject-To Sale?

- The seller is behind on payments or facing foreclosure.

- The home has little equity, so a cash offer wouldn’t be practical.

- The seller needs a fast, hassle-free transaction.

- The existing mortgage has a low interest rate, which is appealing to buyers in a high-rate environment.

For sellers, this strategy can offer a lifeline, allowing a quick exit, helping to avoid foreclosure, and potentially receiving some money at closing.

Additionally, a subject-to sale can benefit sellers who are relocating suddenly due to job changes, family circumstances, or other time-sensitive situations. Instead of waiting for a traditional buyer to secure financing, which can take weeks or fall through entirely, a subject-to transaction allows the seller to hand off the mortgage responsibility quickly and move forward. While it may not yield full market value, the speed and simplicity of the process can be a worthwhile tradeoff – especially when time and financial stability are at stake.

Benefits of a Subject-To Deal for Sellers

- Avoid foreclosure or damage to credit.

- Sell quickly, often within days or a few weeks.

- May receive a cash amount at closing from the buyer (depending on the agreement).

- No need to pay off the mortgage upfront.

Common Concerns from Sellers — and How They Are Addressed

“What about the due-on-sale clause?”

“What about the due-on-sale clause?”

“Will this affect the seller’s ability to buy another home?”

“The loan stays in the seller’s name – is the seller still responsible?”

“What if the buyer stops making payments?”

Who Typically Sells Their Home Subject-To?

- Sellers facing foreclosure or behind on payments.

- Sellers who need to move and sell quickly.

- Homeowners with little or no equity.

- Owners with a low-interest mortgage they can pass along as a selling point.

This strategy is not only for people in financial distress – some sellers simply prefer the ease and speed of a subject-to sale over the traditional route.

Subject-to sales may also appeal to investors or landlords looking to offload properties without the hassle of repairs, showings, or waiting for a buyer’s financing approval. In some cases, even inherited property owners – who don’t want to keep the home or deal with listing it – might opt for this approach. The common thread among these sellers is a desire for convenience, speed, or relief from an unwanted financial burden, rather than maximizing profit.

How to Complete a Subject-To Sale Safely

Sellers considering this option should:

- Work with a knowledgeable real estate professional or investor.

- Hire a real estate attorney to review the agreement or carefully review the documents personally, if confident.

- Use a third-party loan servicing company to manage payments, if possible.

- Document everything clearly, including who pays what and when.

Summary

A subject-to sale can be a smart, strategic solution for sellers looking to avoid foreclosure, exit quickly, or move a property that’s hard to sell traditionally. While it may sound unusual, this method has been used for decades and can be perfectly legal and safe when properly structured.

If you’re a seller exploring options and want to understand whether a subject-to transaction might work for your situation, contact us. We’ll explain everything clearly and connect you with professionals who know how to do it right.

References and Sources

- Real Estate Skills – Subject-To Mortgage Guide

https://www.realestateskills.com/blog/subject-to-mortgage

Detailed overview of subject-to mortgage transactions, including legal structure, buyer and seller considerations, and tips for safer deals. - DSLD Mortgage – What Is a Subject-To Mortgage?

https://www.dsldmortgage.com/blog/what-is-a-subject-to-mortgage

A mortgage lender’s explanation of subject-to sales, with a focus on the structure, who it benefits, and when it might be a good solution. - Marina Title – Subject-To Transactions: Pros, Cons, and Title Considerations

https://marinatitle.com/subject-to-transactions-pros-cons-and-title-considerations

Legal-focused article outlining the benefits and risks of subject-to transactions, especially from the title and closing perspective. - LBC Mortgage – Subject-To Existing Mortgage: Why Buy Someone Else’s Mortgage?

https://lbcmortgage.com/subject-to-existing-mortgage-why-buy-someone-elses-mortgage

Explores why buyers consider subject-to financing and what sellers should know before agreeing to this type of deal.

The information on this page is for general informational purposes only and does not constitute professional advice. SafeVHS is not responsible for any decisions made based on this content. Please consult a qualified professional for guidance specific to your situation.